Portfolio Rebalancing: A Powerful Investment Strategy

Have you ever thought about how you can further increase your investment portfolio’s gains, without adding any additional risk or increasing the investment decision-making’s complexity any further? Well, there is a strategy that can do just that, and it’s called portfolio rebalancing.

Rebalancing can be the greatest ace up your sleeve, as it can bolster the diversity of your investments while also ensuring the consistency of your gains. And, as a cherry on top, it will also help you adapt to the ever-changing market tribulations.

Fine-tuning your investments will help you capitalize on different moves in the markets. Even if the market goes up, or down, you will know how to react to it, and your portfolio will profit from it.

You can read more about portfolio rebalancing in this article, which will provide data-driven evidence that clearly demonstrates the superiority of this technique, compared to the “hodl”, aka long-term, no-change investing. This technique will transform your financial strategy, and ensure your financial future!

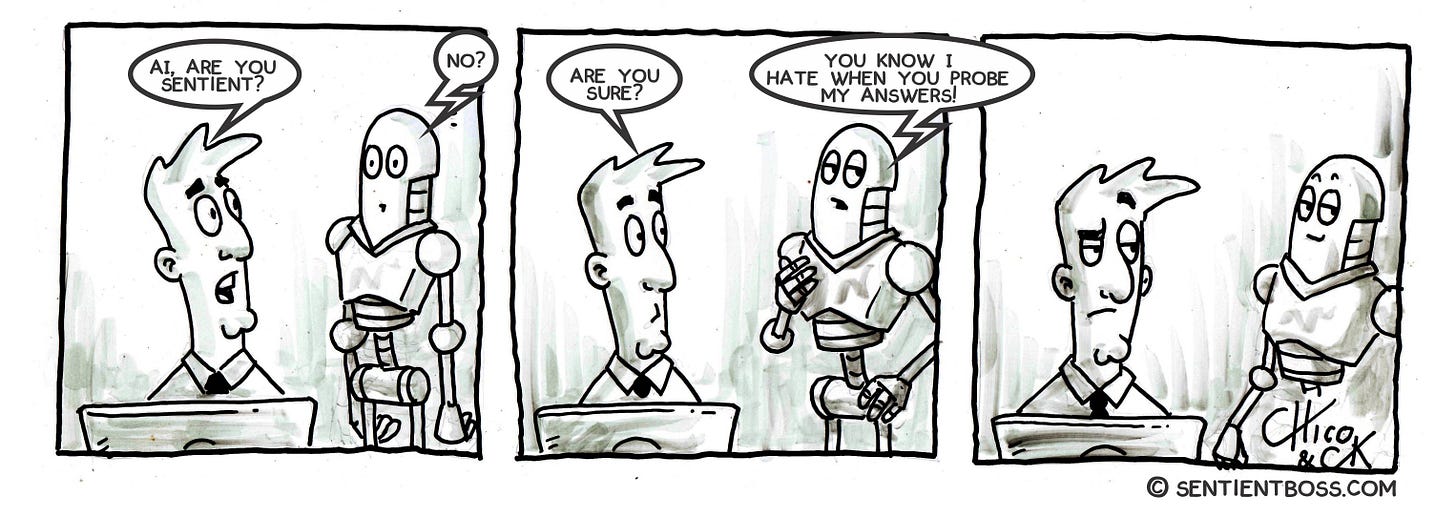

Trust Me (Sentient AI)

How Did NVIDIA (NASDAQ: NVDA) Get Into AI Before Anyone Else

By luck or strategy?

I’ll be a bit more precise — How did NVIDIA know that its graphics cards would be the way of the future with AI processing?

I think that question is too much of a mouthful so my title is better.

Keep reading with a 7-day free trial

Subscribe to DDIntel to keep reading this post and get 7 days of free access to the full post archives.